7 tips for using mobile check deposit

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

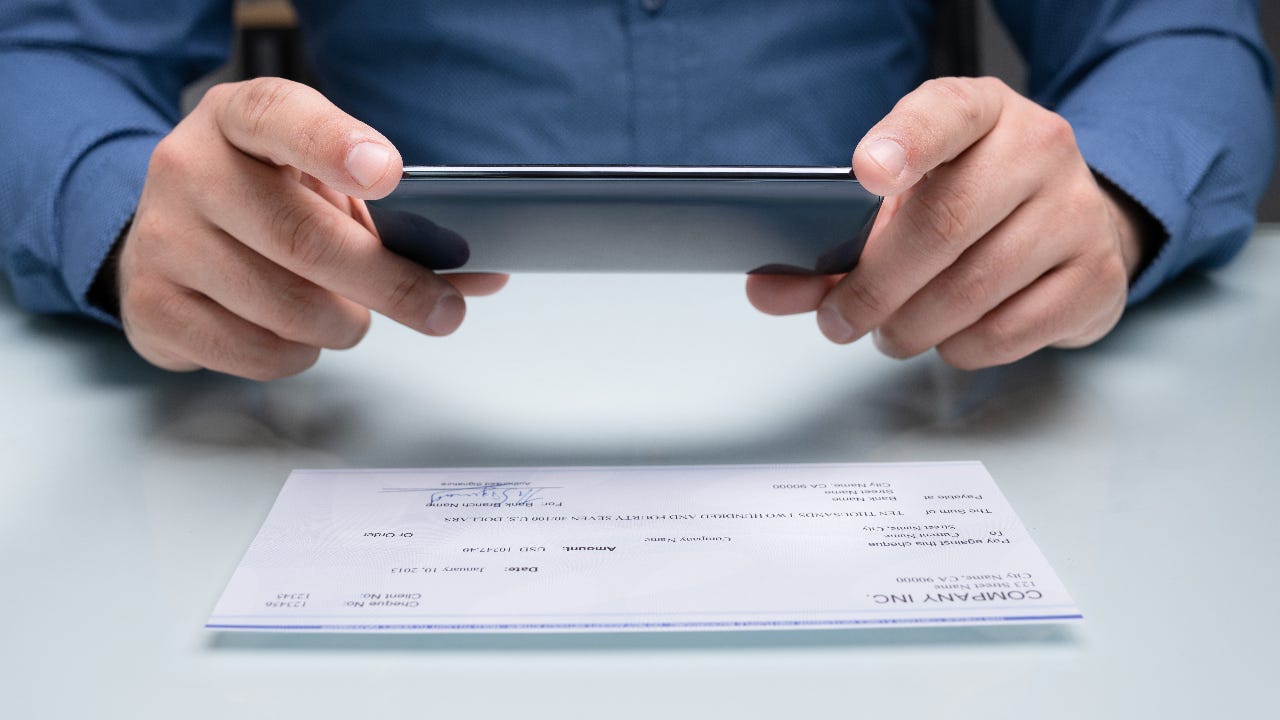

Depositing money or cashing a check used to involve a trip to the bank, which could be both time consuming and inconvenient. But mobile check deposit has eliminated those frustrations, making many banking transactions as easy as taking a photo, at any time of day.

If you have a smartphone, chances are you can use mobile check deposit, provided your bank includes the feature in its mobile banking app.

What is mobile check deposit and is it safe?

Consumers can save time by depositing checks remotely. Instead of bringing a check to the bank, mobile check deposit allows you to snap pictures of the front and back of a check, upload them to an app and deposit the check digitally.

In the banking industry, these digital transactions are referred to as remote deposit capture. These transactions are convenient and safe. They’re processed directly through the bank’s digital platform, and the data you send is protected by encryption. Plus, unlike in-person check deposits, you receive an immediate electronic confirmation or receipt after making a mobile check deposit.

Still, ensure that the banking app you download to complete a mobile check deposit is from the bank itself, and not a random source, to avoid potential fraud. Fraudulent mobile apps accounted for nearly 40 percent of all fraud attacks in 2021, according to a report by Outseer, a provider of payment fraud protection services. Banks typically provide links on their websites for safely downloading their apps.

What to know about mobile check deposits

1. Your bank can cap how much you can deposit

Banks often place a limit on the total dollar amount of mobile deposits that can be made, which restrict how much customers can deposit daily or monthly.

The maximum amount varies by bank. At Santander Bank, for example, there’s a daily mobile deposit limit of $2,500 for customers who’ve had an account for at least 90 days. Otherwise, the daily limit is $1,000.

“Mobile check deposit limits are set to reduce the risk of fraudulent checks being deposited,” says Urjit Patel, chief operating officer of Education First Federal Credit Union. “If you have to deposit checks in excess of predetermined bank limits, you have the option to visit a branch or ATM to facilitate the transaction.”

2. Endorse the check before depositing

Before you start snapping pictures, make sure to endorse the check.

“Checks will need to be endorsed just as they would if you were depositing them in-person at your bank,” says Bonnie Maize, a financial advisor at Maize Financial in Rossville, Kansas.

“However, there’s an additional step for mobile deposits: Some checks may have a box on the back that says ‘For Mobile Deposit’ that you need to check. If the check you are endorsing doesn’t have this, be sure to write ‘For Mobile Deposit Only’ or the version of this statement that your bank requires under your signature.”

3. Taking the right picture is a snap with an app

Having clear and well-lit pictures of your check is essential. Luckily, banking apps are smart and can guide you to ensure good image quality.

“I think the most valuable feature offered is the automatic snapshot feature that takes the photo automatically when you have the photo box closely outlined around the check,” says Bill Samuel, owner of real estate development company Blue Ladder Development and a frequent depositor of mobile checks.

Having a dark background behind the check can help improve photo quality. After positioning the check within the screen’s frame, the app will automatically snap or prompt the user to take the picture. The same procedure is repeated for both sides of the check.

4. Check images aren’t stored on your phone

You might wonder who is going to have access to the sensitive information displayed on a check, but check images aren’t stored on your phone. Instead, bank apps typically “store the deposit data, including images, on a secured web-based server, thereby protecting the customer and the integrity of their financial information,” says credit union executive Patel.

5. Deposited checks can bounce even after confirmation

Checks can still be returned when deposited via smartphone.

“Checks may bounce just as they would if you had deposited them at your local bank branch,” says Maize, the Kansas-based financial advisor. The bank may return the deposit if the issuer has insufficient funds. The check could also be returned if there’s any issue with the mobile deposit, such as if the captured images are illegible or the check is missing an endorsement.

For mobile deposits, the bank may notify you with a confirmation that the check went through. But the bank has the right to return the deposit even after the confirmation is received.

It may take a few days for the transaction to be finalized, which “can be a surprise for young people who are accustomed to financial transactions going through immediately,” Maize says.

6. Banks can place a hold on mobile-deposited funds

Just like a regular check, your bank can place a hold on the funds deposited by smartphone. A common reason for so-called delayed availability of funds is that the funds were deposited too late in the day. After a certain cutoff time for check deposits, the depositor may have to wait an extra business day for the check to clear and for the funds to become available.

7. Hold on to the check

“Hang on to the check until you see it clear and move from pending to approved on your online statement,” says financial advisor Michael Foguth, president and founder of Foguth Financial Group headquartered in Brighton, Michigan.

Wells Fargo recommends storing a hard copy of the check for five days. It can be tempting to toss the check directly into the shredder, but that could lead to problems if the bank has a question about the deposit.

Bottom line

Taking advantage of the mobile deposit feature through a bank’s app can save you time and a trip to a branch. Be sure that the amount you deposit doesn’t exceed the bank’s limit and hold onto any check for a few days after submitting it.

If your current account doesn’t offer this feature, it may be worth researching checking accounts to find one that comes with mobile check deposit and other helpful digital banking features.

–Freelance writer Sarah Sharkey contributed to a previous version of this article.

Related Articles